The Hsmb Advisory Llc Ideas

The Hsmb Advisory Llc Ideas

Blog Article

Little Known Facts About Hsmb Advisory Llc.

Table of ContentsThe Greatest Guide To Hsmb Advisory LlcHsmb Advisory Llc - TruthsThe Best Guide To Hsmb Advisory LlcWhat Does Hsmb Advisory Llc Mean?Hsmb Advisory Llc Things To Know Before You BuyThe Facts About Hsmb Advisory Llc Revealed

Ford claims to steer clear of "cash money value or long-term" life insurance policy, which is more of a financial investment than an insurance coverage. "Those are very complicated, featured high commissions, and 9 out of 10 individuals don't need them. They're oversold since insurance policy representatives make the largest commissions on these," he says.

Impairment insurance can be pricey, nevertheless. And for those that select lasting care insurance, this plan may make handicap insurance coverage unnecessary. Review extra regarding long-term treatment insurance and whether it's appropriate for you in the next area. Long-lasting treatment insurance can help pay for expenditures connected with long-term care as we age.

Fascination About Hsmb Advisory Llc

If you have a persistent health issue, this sort of insurance could wind up being vital (Health Insurance). Nevertheless, don't let it worry you or your bank account early in lifeit's typically best to secure a plan in your 50s or 60s with the expectancy that you will not be using it until your 70s or later.

If you're a small-business owner, think about safeguarding your source of income by buying company insurance coverage. In case of a disaster-related closure or period of restoring, company insurance policy can cover your earnings loss. Think about if a significant climate event affected your store front or manufacturing facilityhow would certainly that impact your income? And for how lengthy? According to a report by FEMA, in between 4060% of tiny services never resume their doors adhering to a catastrophe.

And also, utilizing insurance can occasionally set you back more than it conserves in the long run. If you get a chip in your windscreen, you may consider covering the fixing expenditure with your emergency savings instead of your auto insurance policy. Life Insurance.

Some Known Details About Hsmb Advisory Llc

Share these pointers to safeguard enjoyed ones from being both underinsured and overinsuredand talk to a relied on specialist when needed. (https://fliphtml5.com/homepage/nntoi/hsmbadvisory/)

Insurance policy that is bought by an individual for single-person insurance coverage or protection of a family. The individual pays the premium, instead of employer-based health insurance coverage where the employer usually pays a share of the premium. People may purchase and purchase insurance policy from any type of strategies offered in the individual's geographical region.

Individuals and family members may qualify for economic support to reduce the expense of insurance policy premiums and out-of-pocket expenses, yet only when enlisting through Attach for Health Colorado. If you experience specific changes in your life,, you are eligible for a 60-day duration of time where you can enroll in an individual plan, also if it is outside of the annual open enrollment duration of Nov.

15.

It may appear simple however understanding insurance kinds can also be puzzling. Much of this complication comes from the insurance policy sector's ongoing objective to make customized protection for insurance holders. In developing versatile policies, there are a range to pick fromand every one of those insurance coverage types can make it tough to recognize what a specific policy is and does.

The Ultimate Guide To Hsmb Advisory Llc

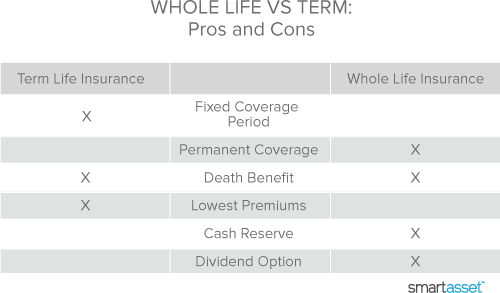

The ideal area to start is to discuss the difference in between the 2 sorts of fundamental life insurance policy: term life insurance policy and irreversible life insurance policy. Term life insurance coverage is life insurance policy that is only energetic temporarily duration. If you die during this period, the person or people you have actually called as beneficiaries may obtain the cash payment of the policy.

Lots of term life insurance policy policies allow you convert them to an entire life insurance policy, so you do not lose insurance coverage. Commonly, term life insurance plan premium repayments (what you pay monthly or year right into your plan) are not secured in at the time of acquisition, so every 5 or 10 years you possess the policy, your costs could increase.

They also often tend to be more affordable overall than whole life, unless you get an entire life insurance coverage plan when see it here you're young. There are also a few variants on term life insurance. One, called group term life insurance policy, prevails among insurance coverage options you might have access to with your employer.

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

One more variation that you may have accessibility to through your company is supplemental life insurance policy., or funeral insuranceadditional protection that can help your family in situation something unanticipated happens to you.

Permanent life insurance coverage merely refers to any type of life insurance plan that does not run out.

Report this page